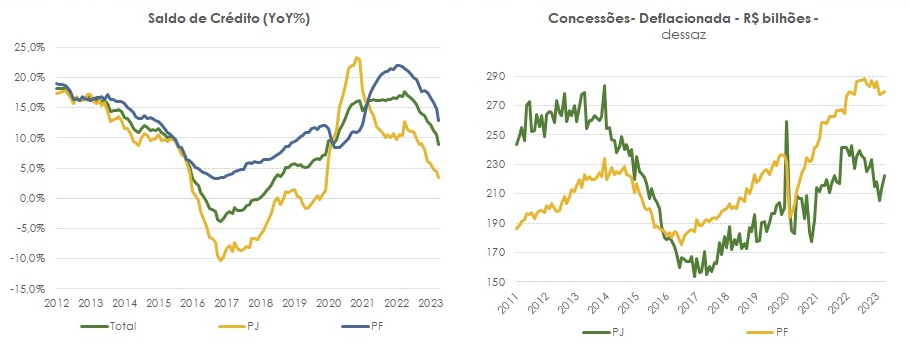

Broadly speaking, the composition of the credit notes for June came out better than expected, contrary to what previous data were showing.

Real concessions saw a 2% advance on a monthly basis, mainly driven by individuals, especially in the portfolio of free ones.

The stronger PJ concession is mainly explained by a substantial drop in interest rates that echo expectations of interest rate cuts as well as a more benign default scenario, where delay data (15 to 90 days) were already showing some stability.

Default also showed stability in the month across all credit lines. It is important to highlight that in June, the “Desenrola” was not yet active, which suggests that the perspective of default may continue a path of deceleration.