In September, the credit balance grew by 0.8% on a monthly basis and 8.0% on a YoY basis. The deceleration process of the annual comparison of the balance continues, with the Individuals line decreasing from 11.8% YoY to 10.5% YoY, and the corporate line dropping from 5% to 4.4%.

Regarding disbursements, there was a 1.2% MoM growth with seasonal adjustments. Corporate loans (PJ livres) stood out positively with a 2.7% growth. However, disbursements to households experienced a 0.4% decline, with unrestricted (credit) remaining stable at 0.0%.

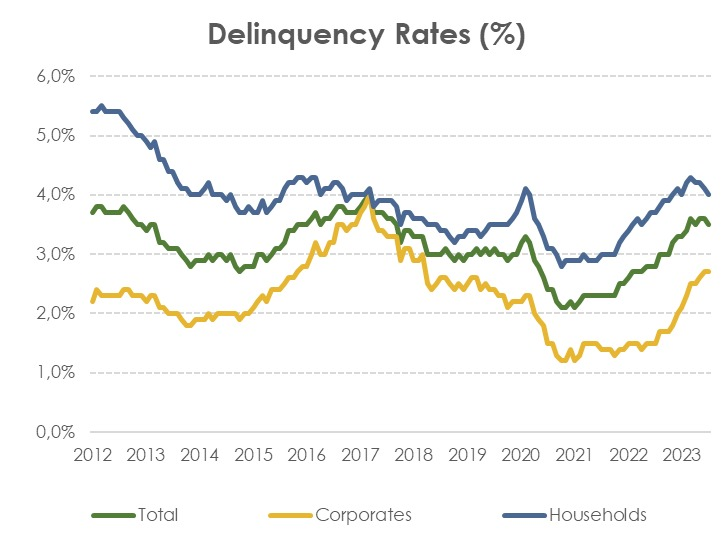

The delinquency rate is another positive aspect of the note, with a decrease in Individuals (PF) and the maintenance of the corporate level (PJ). The total delinquency rate decreased from 3.6% to 3.5%, showing positive signs in terms of risks to the financial sector.

In general, the note appears to be positive, with a slight reduction in risks and the realization of the clearer effects of monetary policy.