Data release: 10/24/2022

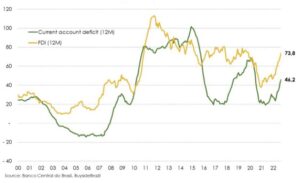

The current account deficit registered US$ 5.7 billion in September, worst then expected by the market (US$ -3.1 bln), reflecting mainly profits and dividends remittances, which reached US$ 5.3 billion in the month (against US$ 3.6 bln in July – last data released by Banco Central do Brasil).

> Debt securities were US$ 1.2 billion in September, totalizing US$ 6.5 billion in debt expenses.

> On the other hand, FDI (foreign direct investment) came stronger: US$ 9.2 billion, way above the expectation (US$ 5.0 bln). The constitution of this result, though, was not the best: in September, intercompany loans accounted for most of this number, US$ 5.7 billion, while equity capital registered US$ 3.4 billion – bellow previous months, but still corresponding to an important share in the year and at a higher level than 2021.

> Compared to July, exports maintained the level, but imports grew, which contributed to a lower trade balance – in September this result was US$ 2.4 billion, against US$ 4.2 billion in July. In August, this fall trend had already happened (US$ 2.5 bln).

> Equity and investments fund, which were negative in July, registered another outflow of US$ 3.9 billion in September. However, in fixed income there was an inflow of US$ 1.2 billion, due to Brazilian high interest rates.

> Besides, there was a 74% rollover rate in September (average of 96% in 12 months), below previous months – in August, there was a 132% rollover rate.

> Finally, Brazilian direct investment abroad, which increased strongly last year, kept positive: in August registered US$ 1.9 billion and dropped to US$ 760 million in September. Brazilian portfolio investments abroad, however, was negative in US$ 979 million in the last month.