Summary

Tax Collection of R$ 201.8 billion in July, close to expectations (Buysidebrazil: R$ 201.2 billion; market: R$ 202.1 billion).

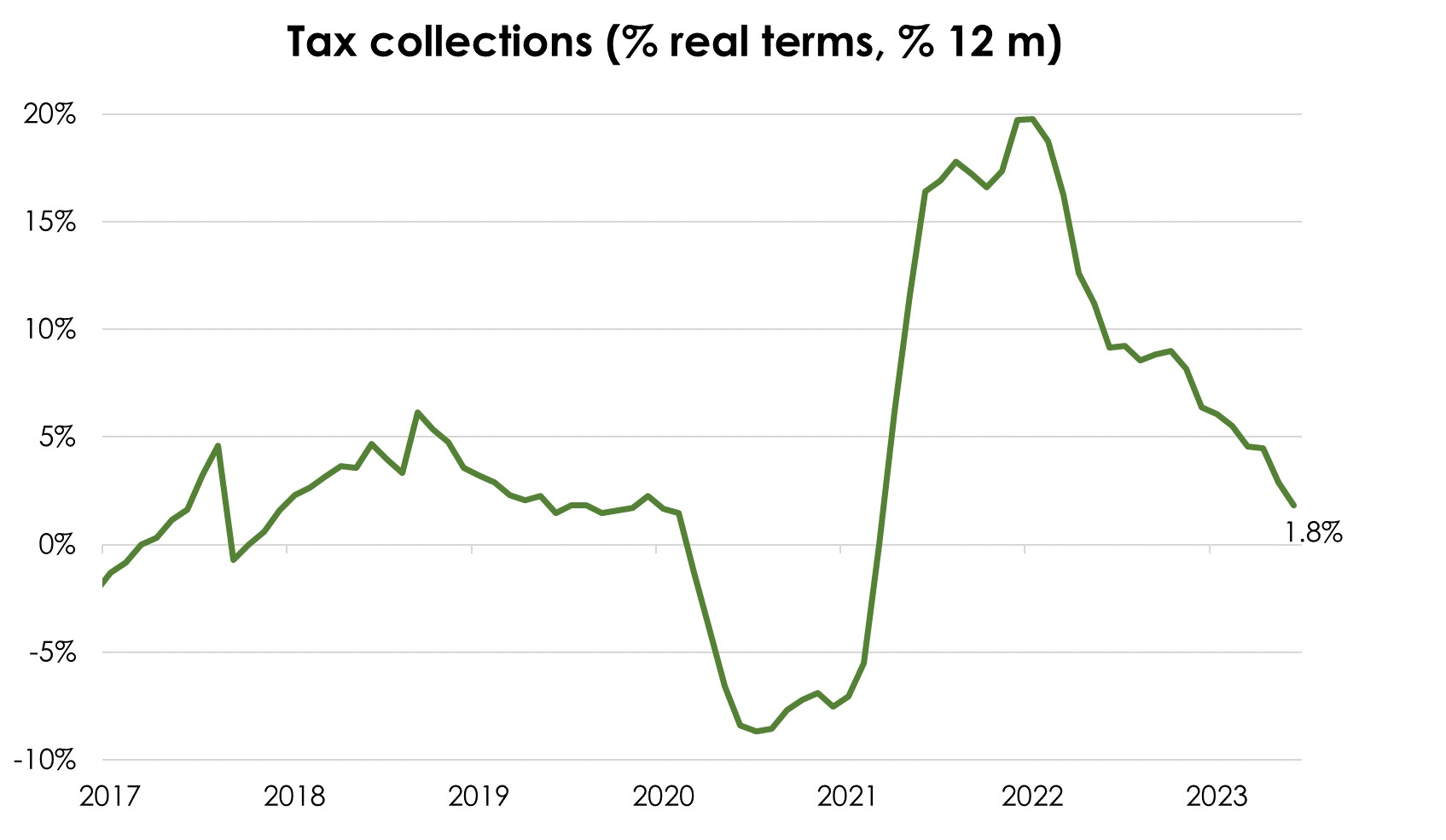

In real terms, this result represents a 4.2% YoY and 1.6% MoM decrease.

The breakdown revealed notable declines in items related to economic activity, such as Corporate Income Tax (IRPJ), Social Integration Program (CLSS), and Tax on Industrialized Products (IPI). On the other hand, PIS/PASEP and Cofins showed improvement, benefiting from the resumption of these federal fuel taxes. Social Security revenue remained resilient amid the still strong labor market.

View

We expect the slowdown of federal revenue to continue in 2H23, in line with the economic moderation (despite some resilience in the services sector’s activity). At the same time, fiscal indicators have been showing an acceleration of expenditure growth. In this regard, we emphasize the importance of additional revenue sources to achieve the primary surplus targets.