Data release: 11/10/2022

IPCA (CPI) – September

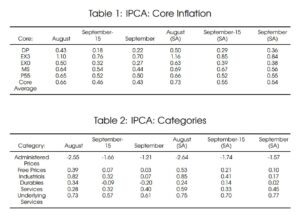

> IPCA registered a variation of -0.29%, higher than expected by us (-0.32%) and by the market (-0.33%). Despite the slightly stronger number, average core inflation showed a marginal slowdown, and the data as a whole reinforces our more optimistic view of prospective inflation.

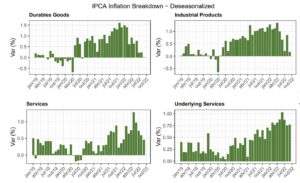

> Services recorded an advance compared to IPCA-15 (preliminary inflation), but in our view, this represents normal volatility of the data. In general, we noted a deceleration trend in the group. In our view, some factors justify this trend, the first being the weakest inflation in 12 months, which generates less inertial pressure. Another element that cannot be ruled out is the effect of monetary policy, which is beginning to appear and is expected to intensify as of the last quarter of this year.

Industrial goods were the main reason for this disclosure’s deceleration of inflation cores since they registered a variation close to 0% in the seasonally adjusted data. This decompression process should continue in the coming months, as the price data referring to the previous stages of the industrial production chain already show a deflation of around 1%. This dynamics of industrial goods cannot be ruled out, given that the rise in the cores observed throughout 2020/2021 was led precisely by this group. Also, at that time, it was what motivated the increase in the basic interest rate by the Brazilian Central Bank.

In addition to the cores, this IPCA showed a stronger-than-expected slowdown in household food, which imposes a downward bias on the group for the rest of the year. For the next year, we see an even more positive outlook, with an emphasis on meat, which has a higher income elasticity than other food groups and, given the global slowdown, should be less demand in the external scenario. Regarding the increase in the supply of cattle due to the reversal of the livestock cycle, the consequence is the reduction in the price of meat in the domestic market.

Finally, we project inflation of 5.65% in 2022 and 4.7% in 2023. As has been highlighted, there is a bearish bias in both projections.