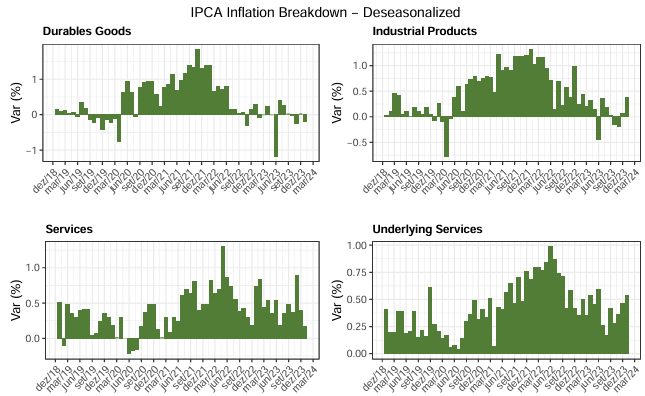

Our view: Headline and breakdowns worse in January reading raise a red flag for short-term inflation, especially for Underlying Services, although we believe these pressures should be temporary, maintaining our more constructive scenario for inflation in the year.

January’s IPCA recorded a rise of 0.42% MoM, above our projection (0.39%) and the market median (0.34%).

Regarding our number, the surprise concentrated on Personal Expenses, especially in Personal Services and Banking Services, which pressured Underlying Services. In this group, we continue to observe higher variations, possibly reflecting an annual adjustment of service providers that should dissipate over the next few months.

In the last COPOM minutes, the committee reinforced concern about underlying inflation, highlighting the potential impacts of a more resilient labor market and the consequences of raising the minimum wage and social benefits. With today’s data release, Underlying Services inflation gains even more attention, worsening the scenario marginally and consolidating a more cautious stance by the Central Bank in conducting monetary policy. For the upcoming meetings, we maintain the view of cuts of 0.50 pp with a terminal rate of 8.75%.

Still, under upward pressures, increases in Clothing stood out, above the expected seasonality, and in Health and Personal Care, where we already incorporated a higher variation in Personal Hygiene than expected by the market.

Food at Home came in line with our expectations, reflecting a more positive climatic scenario for food. Residential Energy, on the other hand, came in below expectations, pulling down the Administered number.

The core average recorded an increase of 0.43%, compared to 0.46% in December 2023, decelerating marginally. For now, we maintain our expectation of 3.5% for 2024, with a more constructive view of inflation throughout the year.