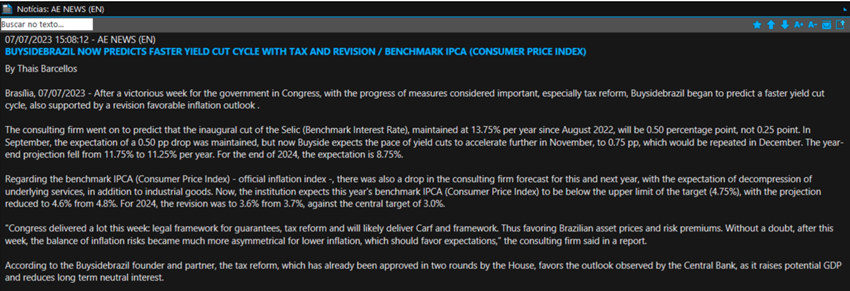

Buysidebrazil now predicts a faster yield cut cycle with tax and revision/benchmark IPCA (Consumer Price Index)

After a victorious week for the government in Congress, with the progress of measures considered important, especially tax reform, Buysidebrazil began to predict a faster yield cut cycle, also supported by a revision favorable inflation outlook.

The consulting firm went on to predict that the inaugural cut of the Selic (Benchmark Interest Rate), maintained at 13.75% per year since August 2022, will be 0.50 percentage points and 0.25 points. In September, the expectation of a 0.50 pp drop was maintained, but now Buyside expects the pace of yield cuts to accelerate further in November, to 0.75 pp, which would be repeated in December. The year-end projection fell from 11.75% to 11.25% per year. For the end of 2024, the expectation is 8.75%.

Regarding the benchmark IPCA (Consumer Price Index) – the official inflation index -, there was also a drop in the consulting firm forecast for this and next year, with the expectation of decompression of underlying services, in addition to industrial goods. Now, the institution expects this year’s benchmark IPCA (Consumer Price Index) to be below the upper limit of the target (4.75%), with the projection reduced to 4.6% from 4.8%. For 2024, the revision was to 3.6% from 3.7%, against the central target of 3.0%.

“Congress delivered a lot this week: legal framework for guarantees, tax reform and will likely deliver Carf and framework. Thus favoring Brazilian asset prices and risk premiums. Without a doubt, after this week, the balance of inflation risks became much more asymmetrical for lower inflation, which should favor expectations,” the consulting firm said in a report.

According to the Buysidebrazil founder and partner, the tax reform, which has already been approved in two rounds by the House, favors the outlook observed by the Central Bank, as it raises potential GDP and reduces long-term neutral interest.

Source: Broadcast